Land Tax

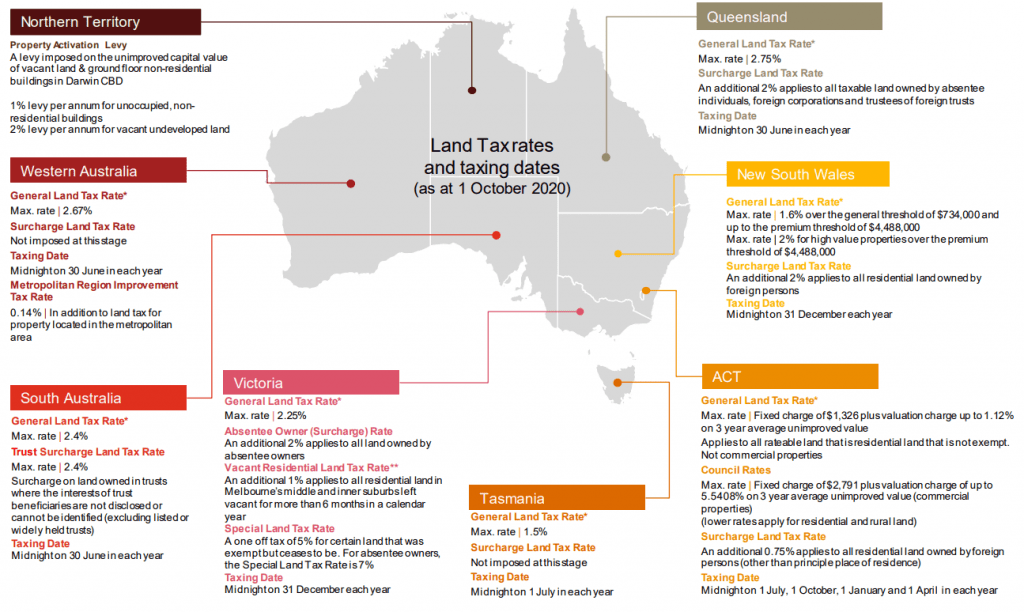

Land tax is a state tax, calculated on the freehold land you own in any state of Australia (except the Northern Territory). All states and territory governments in Australia (except the Northern Territory) impose a land tax, and each state assesses land tax based on the value of land that you own within that state.

Land tax is based on the accumulative value of all unimproved land that you own, other than your principal place of residence in any particular state.

The tax rate that applies depends on what type of owner you are, the total taxable value of your land, and if any exemptions apply.

The state government collects land tax to provide government services and infrastructure for the residents of the state.

Land tax is something that you need to be aware of as you accumulate more and more properties. Because it can become quite expensive if you do not prepare yourself for it properly.

The first thing that you need to be aware of when it comes to land tax is that there are thresholds that you need to hit in any given state before you start getting charged land tax. Every state assesses and charges land tax differently. For example, currently for individuals, the land tax threshold in different states are as follows:

- New South Wales – $755,000

- Queensland – $600,000

- South Australia – $450,000

- Victoria – $250,000

- Western Australia – $300,000

Basically, you do not pay land tax until the value of your land reaches the above mentioned thresholds. It is important to know that land tax is not the value of your property as a whole. It is the value of the land that you own. So, for example, if you are a part of a unit complex, then you will only own a percentage of that land. So, only a percentage of the land’s value will count and the value of the unit itself will not count. If you own a house, it is only the land they are looking at, it is not the land plus the dwelling that is on the land.

When it comes to assessing land value, it is done by the government or by parties that the government hire to do it. For example, in Queensland, the assessment is done by the Department of Natural Resources and Mines. The government then tell you how much your land is worth and your land tax calculations are done on top of that. There are ways that you can dispute it and try and get it changed if you need to.

Also, there are a lot of different exceptions as well to paying land tax. For example, in most if not all cases, your principal place of residence is exempt from the land tax payment and from the threshold, so it does not add to the value of the land that accumulates towards paying land taxes. There are various other exemptions based on the type of land whether it is commercial or personal.